PROPERTY REGISTRATION AND LAWS RELATING TO PROPERTY TRANSACTIONS IN INDIA

Legitimate title to the ownership of an immovable property can only be through purchase or succession. The various laws governing the property registration are Central Acts applicable to properties across India and certain state laws as well governing the revenue laws, stamp duty, mutation, property documents etc. A property can be owned by either purchase or if it is gifted or devolves through intestate or testamentary succession. In both the scenarios, the relevant Central laws are:

- Transfer of Property Act, 1882

- Indian Stamp Act, 1899

- Registration Act, 1908

- Real Estate (Regulation and Development) Act, 2016 (RERA)

- Indian Succession Act, 1925

- Hindu Succession Act, 2005

- Power of Attorney Act, 1882

- Consumer Protection Act, 1986

In the scenario of sale or purchase of property, the title and ownership of the property shall come to the buyer only on execution of a registered sale deed and delivery of possession. In certain cases, where land records are with revenue department then the entry in the revenue records is also a supplementary document which substantiates the ownership though it is not an alternative to the sale deed. As per the Registration Act any transaction effecting change of ownership of an immovable property above the value of Rs. 100/- mandates registration with the authority under whose jurisdiction the property is situated. When the property is to be purchased the value of the same shall be determined as per the circle rate/ municipal rates affixed by the state government over the said area. The stamp duty has to be calculated on the said rates only. The said transfer of title is governed by the terms of Transfer of Property Act and Indian Stamp Act. Furthermore, any property whose possession is transferred through lease or rent for a period of more than 11 months should also be registered. If a person has attained the ownership through a gift deed as a donee, then also the same has to be registered and the relevant stamp duty as per the circle rate has to be paid to the government. The records of the registered documents are always available as public records and can be checked and inspected at any time by any person or called for records by any court of law to determine the ownership or transaction in case of any dispute or conflict.

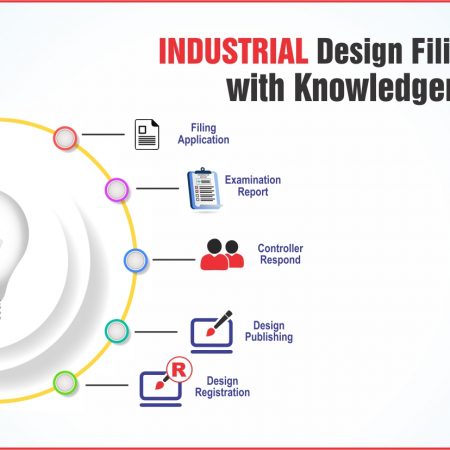

Procedure for Property Registration in India – Once the terms are settled between the parties, the same have to be reduced to writing and then both parties in person or through their registered attorneys (if any) have to be present before the Sub – Registrar within whose jurisdiction the immovable property is situated. The said visit to the Sub – Registrar can be scheduled in advance through online appointment in most of the states and the applicable stamp duty should be purchased. The parties can avail the services of Knowledgentia Consultants whose team is well versed with the nuances of the property registration in India process and documentary requirement. The parties have to appear before the Sub – Registrar with witnesses, all should be carrying their identity card and the seller should also carry the original title deed on the basis of which the seller became owner. Further, the latest property tax receipts, electricity and water bills as paid should also be obtained from the seller along with No objection certificate (if any) required for transfer of connections in the name of the buyer. Once the process and documentation is completed, the sale deed will be properly numbered and kept in the records of the Sub – Registrar and copy of the same would be supplied both to the buyer and seller after registration.

With respect to the flats being under construction or proposed to be constructed, people can invest and once they are allotted the flat they can also obtain loan for the said property. However, the ownership shall devolve only when the conveyance deed is executed but on the basis of Builder Buyer agreement, allotment letter and other documents substantiating the payment another party can also purchase it before registration. However, the rules governing the same shall be RERA and Consumer Protection Act in case there is default by buyer.

On the second arena, if a person obtains an immovable property through succession whether intestate or testamentary then the same is governed by the relevant laws of Succession and Partition as applicable. In case a person dies intestate then all the legal heirs shall have an equal and joint share to the immovable property of the deceased and the same can be either partitioned or mutated in the names of all legal heirs. Once the mutation/partition is done there could be a scenario in which all legal heirs mutually consent to relinquish their right in favour of any one person and for the same, they have to executed and register a Relinquishment Deed in the favour of the one heir. The documentation and registration can be handled by the team of Knowledgentia Consultants who are the best Property Transfer Lawyers in India. The said deed shall be duly registered before the Sub – Registrar and thereafter the sole and exclusive rights shall vest that one person who can sale, rent, lease or exclusively use the property in any manner whatsoever.

However, if there is a will then the person owning the immovable property of its own volition can bequeath the property to any person, whether related or not or to a trust or to any other legal entity or society as per their own wish. In case of testamentary succession, the legal heirs if not named in the will do not have any right over the demised property unless the will is negated by a court of law. The will is a document which is not mandatory to be registered under the Registration Act and if the execution of will is proved to be signed in the presence of witnesses, it is usually upheld by the Court and the ownership of the property can be transferred on the basis of the said will.

Thus, whether immovable property is purchasedor obtained through gift or succession, the title should be clear and unencumbered and you can seek professional assistance for your such requirements at Knowledgentia Consultants.