TAXATION OF ROYALTY AND FEE FOR TECHNICAL SERVICES IN INDIA – A BRIEF OVERVIEW

PUBLISHED ON 10.01.2022 BY MS. HARINDER NARVAN, MS. APARNA JAIN AND MS. AASHRIKA AHUJA

INTRODUCTION

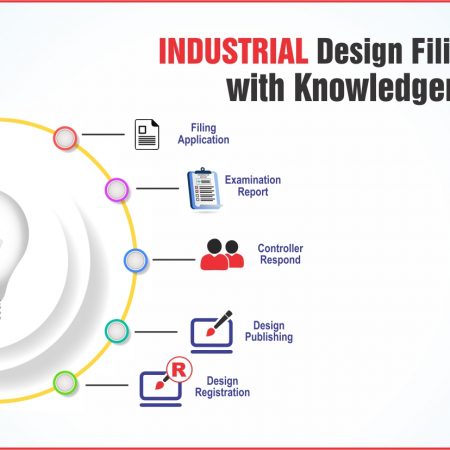

Royalty generally refers to a consideration received by a creator, owner or an inventor in lieu of commercial usage of his invention or artistic work. Basically, any payment received by an owner of intangible right and includes even knowhow under license in case of technology transfer. Payment in nature of royalty on account of use of trademark, patent, design, copyright, brand name, franchise, license, artistic or scientific work, computer software can be either in the form of annual payment or periodical payment as decided by concerned parties. Fee for technical services on the other hand is mostly associated with rendering of managerial, technical or consultancy services. The Indian income tax specifically Section 9 contains many detailed provisions with respect to taxation of royalty and fee for technical services. Royalty and FTS income is taxable in India if service is utilized in India irrespective of place wherever the service is rendered. At Knowledgentia Consultants, which is the best law firm in India providing services relating to Global IPR protection we ensure there is complete transparency in taxation and payment matters so as to avoid any unforeseen situations that might land up our clients in any kind of trouble. Our services are extremely professional and we ensure our clients have minimal concerns with respect to taxation , royalty and any payment related matters.

There have been significant amount of case laws in India that provide how royalty and fee for technical services becomes taxable for residents as well as non residents under Indian taxation laws. There could be various scenarios where people residing in one country are earning royalty in a different country or rendering technical services as well. As a result of cross border exchange of technology, goods and services there could be incidents of double taxation. Hence, to avoid such a situation many countries have entered into Double Taxation Avoidance Agreements. The Indian Supreme Court as well as Income Tax tribunals have time and again through there rulings clarified and settled the law of land in many contentious issues with respect to taxation of royalty and fee for technical services. For instance, the apex court recently in a ruling clarified that there is no liability for Indian companies to deduct tax at source with respect to purchase of software from foreign companies thereby putting to rest a long standing controversy declaring amount paid by Indian end-user or distributor to non resident computer software manufacturer as consideration for resale or use not being royalty for use of copyright and hence non taxable in India. For any queries relating to latest interpretation on integration of IPR and taxation laws in India , Knowledgentia Consultants is one of the best corporate international law firm in India.

BRIEF OVERVIEW OF SH CHANDER MOHAN LALL V. ACIT, ITA NO. 1869/DEL/2019 DATED 09.12.2021.

In this case assessee is an advocate by profession residing in India with core are of practice in Intellectual Property laws. It was observed payment of a certain amount by him to his wife for carrying out professional services relating to interior decoration and repair of his office. This amount was disallowed as excessive under relevant sections and in this case this disallowance is a contested issue. This disallowance however was deleted by income tax tribunal as assessing officer. However what was observed in this case was that assessee claimed deduction of payments made to various entities outside India towards professional and technical fee. Further no TDS was found to be deducted as well. The issue thus examined in this matter was whether any payment made to non residents is chargeable under the income tax act so as to attract Section 195 of the act. In this case, it was identified that non-resident attorneys rendered their professional services outside India in relation to filing of applications for registration of IPR, filing of petitions and responses in relation to process of registration of IPR, maintenance services relating to IPR, various compliances in relation to IPR. Hence, the services rendered by these non resident attorneys in their countries of residence do not make the payment received by them as income received or arising in India. Thus these payments are neither in the nature of interest or in the nature of royalty. Moreover, professional and legal services are treated differently from technical services under the purview of domestic laws in India. Hence it was held that in this case TDS should not have been deducted by the assessee.

Knowledgentia Consultants is one of the best litigation firm in India providing best NRI legal services in India along with IPR matters. We are well versed with all latest trends in the field of matters involving overlapping of taxation and IPR related matters. For our clients locally as well as globally we offer most effective solutions and are your one-stop solution for all kinds of legal, compliance and supplemental matters. In case of any query regarding this matter you may email us at info@knowledgentia.com or visit our website –https://knowledgentia.com/.